Rand Merchant Bank Launches Custody Offering

The largest financial services group in Africa Rand Merchant Bank Nigeria (RMBN) has launched its custody offering, a banking solution aimed at enhancing the ‘post-trading’ activities of clients recently in Lagos.

It was mentioned that, the financial institution commenced the offering of custody services for over 25 years ago out of South Africa.

Hence, the bank thereafter expanded the offering to neighboring southern African countries of Namibia and Botswana in the years 1998 and 2008 respectively and has since become a leading provider of custody services to a number of leading global custodians as it banks over 29 international banks, fund managers, pension funds, broker dealers, among a host of others.

Also, as a key part of its Africa Custody expansion strategy and in line with growing client demand for regional custody services, RMB’s Group management approved the rollout of direct custody offering out of Nigeria in 2018. The RMB Nigeria Custody is open for business and have started signing on clients.

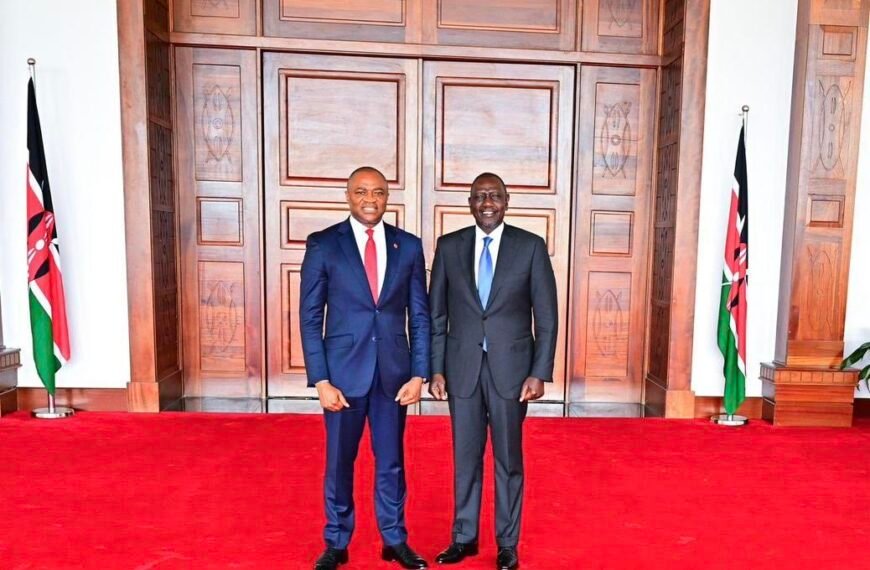

Speaking at the launch the CEO, RMB Nigeria and Regional Head West Africa, Michael Larbie, said his team has the advantage of decades of proven experience, a network across the continent and deep roots in South Africa.

He stated that, it would enable its experts to provide the kind of custody services that safeguard’s clients’ investments. “Clients have recognised our unwavering commitment to constantly improving our services by voting us the market outperformer every year since 2016 in Global Custodian’s Surveys for Agent Banks in Emerging Markets.

“The Nigeria team is committed to building and maintaining sustainable partnerships, while our world-class platforms and systems empower clients to manage their funds from anywhere in the world,” Larbie added.

Alongside, the Head of Global Markets, RMB Nigeria, Nadia Zakari, said the addition of custody services to the product offering of the bank would further deliver end to end efficient trading and post trading experience of the bank’s existing and future clients.

On his part, the Head of Custody, RMB Nigeria, Abiodun Adebimpe, said the RMB Nigeria Custody Services offer domestic client’s access to international markets through our partnership with our South African based team which extends our offering to over 100 markets outside Nigeria.

“Our clients benefit from our strong focus on excellent pre- and post-trading services. We offer our international clients superior end-to-end service experience by supporting them at every stage of the investment cycle, that is account opening, forex trading and documentations, securities trading, clearing, settlement, corporate actions facilitation, reporting, market information among others,” he added.