UBA enhances Kenya’s economic growth with $150m infrastructure pledge

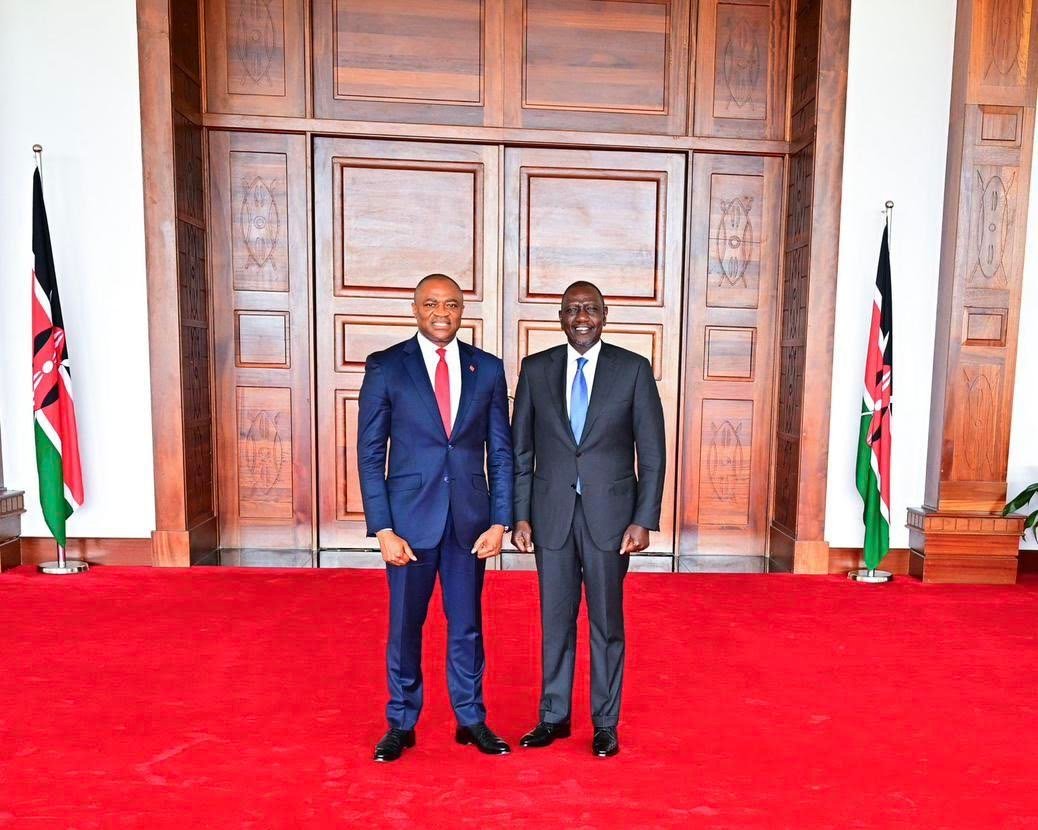

Oliver Alawuba, Group Managing Director and CEO of United Bank for Africa (UBA) Plc, led a high-level delegation to meet Kenyan President William Ruto and other top government officials, reaffirming UBA’s commitment to driving investment and inclusive growth in Kenya and East Africa.

President Ruto, hosting the delegation at State House Nairobi, praised UBA for its longstanding support to Kenya’s development. Discussions focused on UBA’s role in advancing infrastructure, financing small and medium-sized enterprises (SMEs), and supporting Kenya’s long-term economic transformation to boost both national and regional prosperity.

“Kenya is a cornerstone of East Africa’s growth story, and UBA is dedicated to unlocking its immense potential,” Alawuba said. “From funding critical infrastructure to empowering SMEs that drive job creation, we aim to deliver sustainable solutions that connect markets, foster trade, and improve lives across the region.”

The delegation, including Sola Yomi-Ajayi, Executive Director/CEO of UBA Africa, and Mary Mulili, Managing Director/CEO of UBA Kenya, also engaged with key figures such as Dr. Kamau Thugge, Governor of the Central Bank of Kenya. Their talks centered on strengthening financial sector resilience and enhancing cross-border trade through innovative payment solutions.

ALSO READ: MILU KIPIMO LEADS BOLT BUSINESS SOUTH AFRICA

A highlight of the visit was UBA’s pledge of $150 million to Kenya’s Roads Levy Securitization Program, a $1.35 billion initiative led by the Kenya Roads Board. Announced during a meeting with Cabinet Secretary for Roads and Transport Davis Chirchir, the funding will support critical road upgrades, accelerate contractor payments, and enhance national and regional connectivity.

“Infrastructure is the backbone of trade and prosperity,” Alawuba stated. “UBA’s significant contribution to this program reflects our confidence in Kenya’s and East Africa’s future.”

Mary Mulili emphasized UBA’s role as a trusted partner, saying, “Our support strengthens connectivity for farmers, manufacturers, and SMEs, driving economic empowerment across East and Southern Africa.”

Further discussions with Prime Cabinet Secretary Musalia Mudavadi highlighted the importance of African-led enterprises in fostering job creation, innovation, and sustainable growth. Both parties stressed the need for robust partnerships to advance infrastructure and regional interconnectivity, aligning with the goals of the African Continental Free Trade Area (AfCFTA).

With SMEs accounting for over 80% of employment in Kenya, UBA is rolling out tailored financing solutions to bolster entrepreneurship. Alawuba reaffirmed UBA’s vision to position Kenya as a vital hub for East African trade and economic opportunities.