Bank of Ghana Releases Pricing Guidelines for Ghana Gold Coin

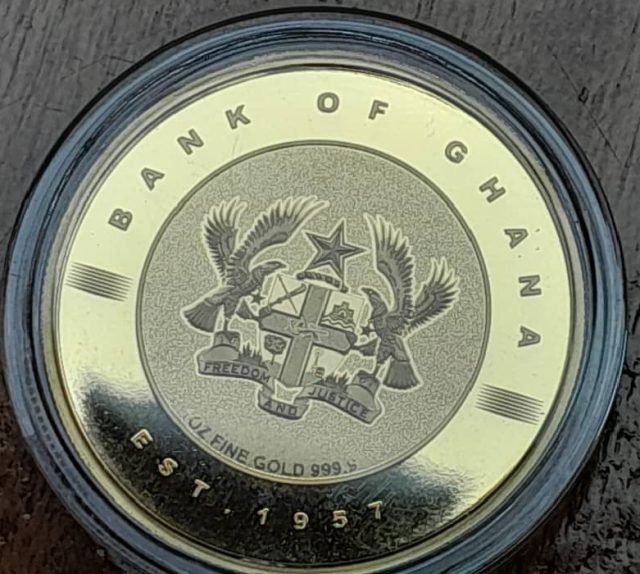

The Bank of Ghana has announced the pricing guidelines for the newly issued Ghana Gold Coin (GGC). The GGC, guaranteed by the Bank of Ghana, is available in three sizes: one ounce, half ounce, and quarter ounce. Each coin features the Ghana Coat of Arms on the front and the Independence Arch on the back, symbolizing national pride and heritage.

The GGC is available in various weights to cater to different investment needs:

– 1 oz Coin: Contains one ounce of pure gold and measures 34mm in diameter.

– 1/2 oz Coin: Contains half an ounce of pure gold and measures 27mm in diameter.

– 1/4 oz Coin: Contains a quarter ounce of pure gold and measures 22mm in diameter.

Commercial banks will serve as the primary channels for the buying and selling of the GGC. To facilitate transactions, these banks are required to open gold accounts with the central bank. According to the pricing released by the Bank of Ghana on Tuesday, November 26, 2024, the GGC will be sold at the following rates:

– 1.00 oz: GH₵45,020

– 0.50 oz: GH₵22,409

– 0.25 oz: GH₵11,188

Purchases can only be made in Ghana through commercial banks using the cedi. The pricing is based on the previous day’s London Bullion Marketing Association (LBMA) Auction PM Price and the previous day’s closing Bloomberg REGN Mid-Rate for the USD to GHS exchange rate. The GGC is crafted from dore gold refined to 99.99% purity, ensuring a high-quality, pure gold product.

Commercial banks may charge a transaction fee for the resale of the GGC. A uniform fee will cover the associated costs, including the value-added aspects and the wooden storage box provided by the Bank of Ghana.

“The issuance of the GGC democratizes access to this enduring financial asset, enabling residents to diversify their financial portfolios,” said Dr. Addison. “This initiative broadens access to a valuable investment, supporting economic growth and individual financial stability.”