Fidelity Bank introduces new training for its staff

Fidelity Bank Ghana has launched the Fidelity Banking Academy, a new capacity-building programme to provide regular, holistic training and competency upskilling for staff of Fidelity Bank.

The initiative, that is being implemented in partnership with the Chartered Institute of Bankers Ghana, will elevate standards in the Ghanaian banking industry with respect to technical skills, and essential non-technical skills such as management and interpersonal skills.

The Fidelity Banking Academy will create an avenue for staff of Fidelity Bank to acquire top-notch skills. It also aims to provide the necessary creative environment for them to conceptualize locally relevant banking innovations that will meet the unique needs of the bank’s diverse customer base.

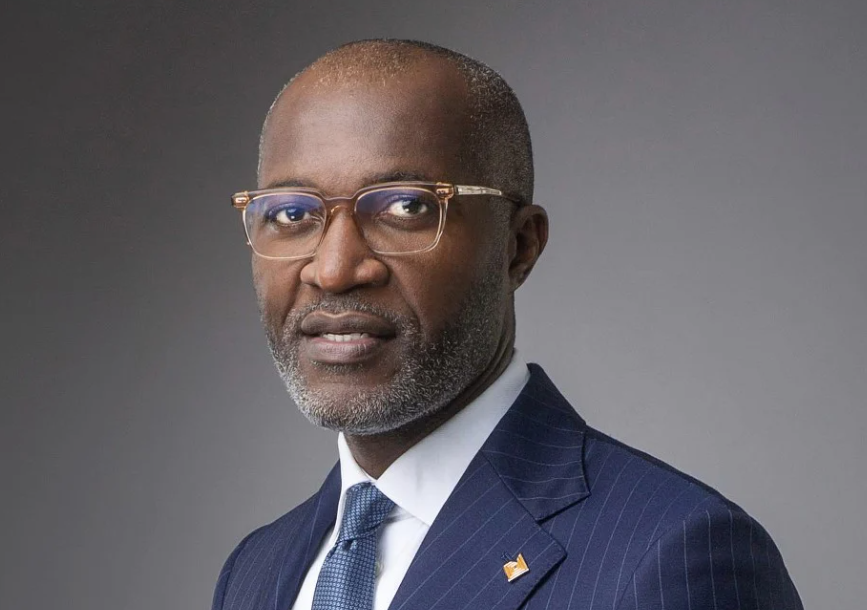

Commenting on the Fidelity Banking Academy, Julian Opuni, Managing Director of Fidelity Bank, stated, “This Academy seeks to produce consummate world-class bankers whose expertise will help to keep our banking industry at par with the very best in the world. Importantly, it will also serve the purpose of regularly upgrading skills of our staff and offering cost efficient and international standard training to meet the pertinent human resource needs of the local banking industry.”

The Director of Human Resources at Fidelity Bank, Owusu Boahen, noted that “The current dynamic landscape of the banking industry requires all banking professionals to sharpen their skills to meet evolving customer demands. We at Fidelity Bank remain committed to equipping our employees with the necessary skills and tools to become the best in the industry, and we believe that this Academy will help us to achieve that objective.”

The Chief Executive Officer of the Chartered Institute of Bankers Ghana, Charles Ofori-Acquah, remarked that, “The Associate Charter Banker programme is the Institute’s flagship qualification for banking education. However, in collaboration with leading financial institutions like Fidelity Bank, the Institute has also introduced certification programmes for practitioners in specialized areas of the banking industry such as Corporate Banking, Retail Banking, and Treasury Management, amongst others. We are happy to partner with Fidelity Bank to pilot this new model to provide opportunities for reskilling and upskilling of practitioners to improve and sustain excellent service delivery.”

The Fidelity Banking Academy will deliver customized programmes/modules for different departments in the bank, including Banking Operations, Risk Management, Corporate Banking, Retail Banking, and more. There will also be an entry-level program to boost the employability and skill level of young people desirous of building a career in the financial sector.

Fidelity Bank‘s introduction of the Fidelity Banking Academy forms part of the Bank’s “Together We’re More” brand promise that views success as a collaborative effort among key stakeholders working together towards a greater good. To this end, Fidelity Bank has demonstrated that by working with the Chartered Institute of Bankers Ghana to train its employees, it is supporting the industry to further contribute to the economic development of the country.

About Fidelity Bank Ghana

In a little over a decade, Fidelity Bank Ghana has grown from a discount house to a Tier-1 Bank and is now the largest privately-owned Ghanaian Bank in Ghana. The bank currently serves its approximately 2 million customers in 75 branches across Ghana and is a leader in the digital banking revolution. The bank has two subsidiaries, Fidelity Asia Bank Limited, which is a wholly owned subsidiary in Malaysia and Fidelity Securities Limited, an asset management firm. In a short period of time, Fidelity Bank has become a household name in Ghana by adopting a customer-centric culture and delivering consistently on the promise of making a difference in the lives of all stakeholders.

Source: Fidelity bank