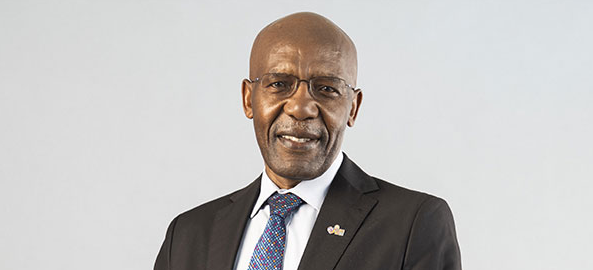

Jumo appoints fintech expert Bradwin Roper as Chief of Payments Partnerships and Executive Committee Member

Jumo, a technology company building next-generation mobile financial services for emerging market entrepreneurs, has announced the appointment of Bradwin Roper as Chief: Payments Partnerships and a member of the Executive Committee. The appointment is effective from November 2024.

In this new role, Bradwin will support the company to deliver its growth goals by shaping JUMO’s payment partnerships. He will focus on scaling and servicing existing partnerships – including with partners such as MTN – and developing new opportunities for digital financial ecosystems.

Bradwin has almost 20 years of experience across financial services, telecommunications, technology, FMCG, engineering, and manufacturing. Most recently, he was MTN’s fintech CEO South Africa where he oversaw the expansion of MTN’s financial services across the country. Before that, Bradwin spearheaded a telecommunications and e-commerce business within FNB South Africa, winning best digital Mobile Virtual Network Operator in the world among other accolades.

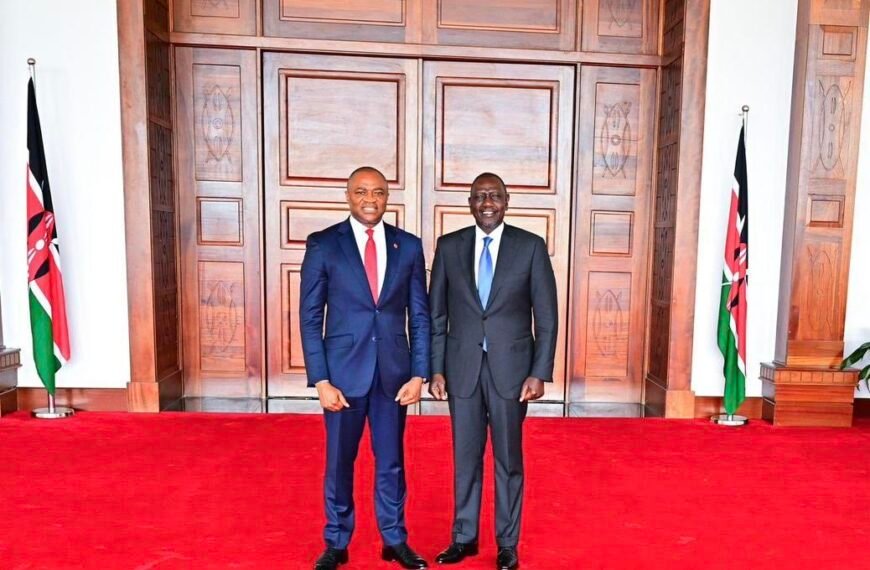

Bradwin’s appointment follows the announcement last year that Joe Mucheru – former Kenyan Cabinet Secretary for ICT, Innovation and Youth Affairs – was appointed President of JUMO.

Andrew Watkins-Ball, JUMO Founder and CEO, said: “Brad’s background is a great fit for our mission. We are working hard to provide banks and payments companies with the technology that they need to profitably serve customers at the lowest possible price.”

Bradwin Roper, incoming Chief of Payments Partnerships, said: “The work I have done over the past few years has sparked an abiding passion to make financial services more accessible through mobile and fintech platforms. I believe my experience and skills will benefit JUMO and their partners significantly in this new role, and most importantly, the everyday entrepreneur, labourer, caregiver or consumer working to realise financial opportunities in Africa.”