Kenya: Forex reserves fall by Sh21bn in September

Kenya’s official forex reserves have fallen by Sh21 billion ($192 million) from the September 9 peak of Sh1.064 trillion ($9.629 billion), reflecting possible intervention by the regulator to ward off shilling volatility and external payments.

The Central Bank of Kenya (CBK) said the reserves stood at $9.437 billion (Sh1.043 trillion) as of September 30, enough to cover 5.77 months’ worth of imports.

The reserves had been boosted during the month by an allocation of $750 million (Sh83 billion) from the International Monetary Fund (IMF), this being Kenya’s share of the Special Drawing Rights allocations the body made to all members in the balance of payment support.

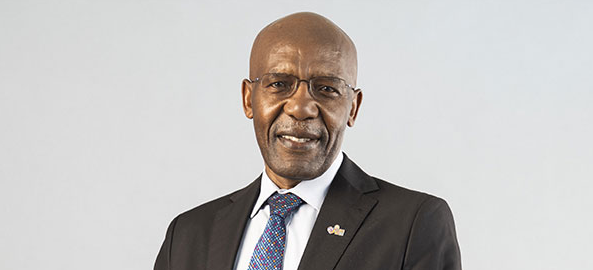

Central Bank of Kenya’s Governor Patrick Njoroge said that the reserves remain sufficient to meet any shock going forward, and are set to be raised in coming weeks by a $300 million (Sh33.2 billion) tranche from the IMF’s three-year, $2.4 billion (Sh265 billion) financing programme with Kenya.

“We don’t expect much concern in foreign exchange market…we believe the reserves are adequate for any potential shocks going forward,” he said in a briefing following the September 28 Monetary Policy Committee meeting.

The banking regulator, as the custodian of the country’s official forex reserves, usually deploys the hard currency when making external payments on behalf of the government, for instance, servicing external debt or paying overseas suppliers.

It can also sell dollars into the domestic forex market to ward off shilling volatility (when there is a weakening), although it does not disclose when it does so or the amounts involved.

The shilling has, however, been under pressure in recent weeks and is currently exchanging at an average of 110.55 to the dollar compared to a rate of 109.77 at the beginning of September.

Given that imports have recovered strongly this year and the trade gap is widening, the currency is likely to come under more pressure, which might call for the regulator’s intervention to prevent volatility.

Support could, however, come from higher diaspora remittances — Kenya’s largest source of foreign exchange —which the CBK estimates will hit $3.4 billion (Sh376 billion) for this year, a 10 percent increase compared to 2020.