Keystone Bank partners Facebook,Google to train MSMEs

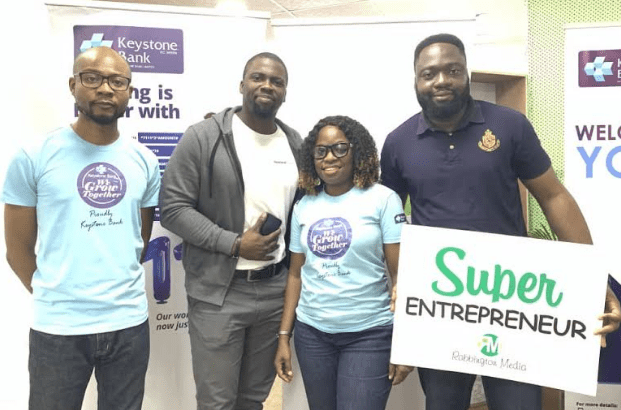

A technology and service-driven financial institution, Keystone Bank Limited, in alliance with the social media giant, Facebook (Rabbington Media) and Google (Innovation Growth Hub)has commenced in training micro, small and medium enterprises (MSME) customers on how to leverage digital social media to achieve their business goals across the country.

According to the report, the first phase of the workshops which were held in cardinal locations such as, Lagos, Benin, Enugu and Onitsha, was aimed at training entrepreneurs and self-employed individuals on how to make maximum use of digital social media to achieve their business goals.

In addition, the participants (comprising of both existing and prospective customers of Keystone Bank) were trained on the advantages of internet marketing, bookkeeping through the digital social media to achieve business and financial growth.

Positively, it was said that the training was engaging, interactive and an exciting lecture which created platforms for over 700 entrepreneurs to take deeper view, develop and deploy their business skills through practical trainings facilitated by experts and successful business owners.

Similarly, in Abuja, the bank in partnership with Pundit Book-keeping Services Limited took its MSMEs customers on the importance and benefits of effective book-keeping and taxation.

Speaking at one of the sessions, the Executive Director, South & Corporate, Keystone Bank Limited, Mr. Yemi Odusanya said the bank is providing businesses and organizations the opportunity to expand their customer reach by projecting their message on global platforms such as Facebook thereby promoting widespread exposure.

Mr. Yemi stressed further that, “Globally, SMEs are established drivers of the strongest economies and Nigeria is not taking a back seat. With over 15million SMEs dotting the Nigerian landscape, we are poised to ensure our customers in this segment actively grow their businesses through our partnerships and focused initiatives in the segment, and this is the basis for our strong support of the MSME sector. MSMEs are the engines of socio-economic transformation, including industrialisation, as they provide vital platform to enhance technological and entrepreneurial capacity among various segments.”

“We are committed to ensuring that our self-employed customers thrive at their various businesses hence we constantly seek ways and means to connect them to the market and ensure they succeed in reaching their customers.” He said.

He explained that, “Giving them a social media presence will aid their appeal to the emerging middle-class customers in Nigeria who will most likely form a larger percentage of their customer base in the near future and are mostly upwardly-mobile youths who connect daily on these platforms at a reassuring rate.”

“The capacity building trainings are available to all Keystone Bank customers who seek a competitive edge to transform their businesses and will be coming to other parts of the country soon.

“Our SME proposition, which is the “Growbiz Account” has three variants that address their cycles of growth from infancy through maturity and stability. We are also empowering SMEs through our Agency Banking initiative by signing them up as agents for basic off-site cash-in/cash-out services,” Odusanya injected.

He further noted that the bank recently re-launched her MSME drive to ensure businesses are well equipped with required knowledge and skills for their growth and survival.

Keystone Bank Limited is one of the financial institutions that has a long-running support for the growth and development of small businesses in Nigeria because of the recognition of critical roles of MSMEs as vital agents of economic development and transformation.

The bank, a technology and service-driven commercial bank offering convenient and reliable solutions to its customers, has a full-fledged SME banking division which over the years, has developed various engagement programmes focused on empowering entrepreneurs.