New car sales down in South Africa- Msibi

The National Automobile Association of South Africa (Naamsa) has said sales of new vehicles declined significantly in February compared to the past months due to Eskom load shedding.

Eskom generates approximately 95% of the electricity used in South Africa and approximately 45% of the electricity used in Africa. Eskom generates, transmits and distributes electricity to industrial, mining, commercial, agricultural and residential customers and redistributors.

Industry sales declined 3016 units and ended the month on 43251 units, 6.5 percent down on the same month last year.

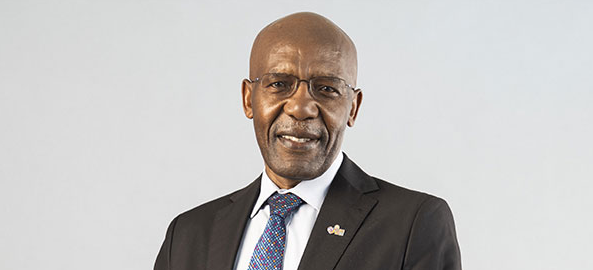

Head of motor WesBank Executive, Ghana Msibi explained that: “While we expect first-half sales to be slow, the market was no doubt rattled by the week-long impact of load shedding at the beginning of the month, which impacted consumer and business confidence”.

Msibi stated that “Reassuringly, however, February sales were up on January despite fewer selling days.”

According to Msibi the additional carbon tax and resultant increase in fuel prices during the month is expected to contribute to consumer behaviour in the longer term and their appetite for new vehicle purchases. Passenger vehicle sales took the brunt of the market’s performance, declining 13.3percent to 27000 cars.

Msibi noted that: “Concerning is the slowdown in consumer demand as evidenced by passenger car sales through the dealer channel declining 14.4percent”.

“This is also reflected in consumer demand for light commercial vehicles (LCVs), despite this segment increasing.” Having showed more resilience over the past few months than passenger cars, LCV sales increased 7.1percent to 14123 vehicles. The dealer channel sales for the segment increased 4.4percent. “The performance of the LCV segment is reassuring. Not only is this segment up year-on-year, but is 2423 units up on January, which remained flat on the previous month,” Msibi added. The remains sobering. “The market remains under enormous pressure and is down 7percent on the first two months of last year, this means a major turnaround is required to meet our forecast for the year of a 1percent decline.”

Affordability continuous to be key to vehicle purchase decisions. Extended contract periods, increasing numbers of huge payment options and a shift from new to used indicate “household budgets under pressure”, Msibi stated.