Nigeria: TAJBank Limited grows pre-tax profit by 433% in 2021

TAJBank Limited, Nigeria’s second non-interest bank recorded more milestones in its second year of operations with its profit before tax (PBT) surging to N1.6 billion in financial year 2021, representing 433% increase over the preceding year’s profit.

This is even as the lender recorded 117% growth in gross revenue from N3.3 billion in 2020 to N7.2 billion in 2021.

In the period under review, the bank recorded positive indicators which showed the remarkable growth that the nascent bank continues to achieve. The bank’s financial results showed a rise in its balance sheet figure from N50 billion in 2020 to N110 billion in 2021 financial year, recording a 122% growth.

The bank also achieved a leap in shareholders’ funds during the year which also marked some great improvements for the Bank’s financial results coming from the previous year.

The non-interest bank’s audited financial statements also reflected outstanding positive indices which demonstrated its management’s professionalism in handling investors’ funds despite serious economic headwinds.

TAJBank’s drive for deposit base growth showed in the financial results as customer deposits also remarkably grew in the year under review, increasing by 99% over the previous year’s value and representing the highest in the industry.

Also, the bank rapidly expanded its branch network by 22 new branches and business offices within the period under review.

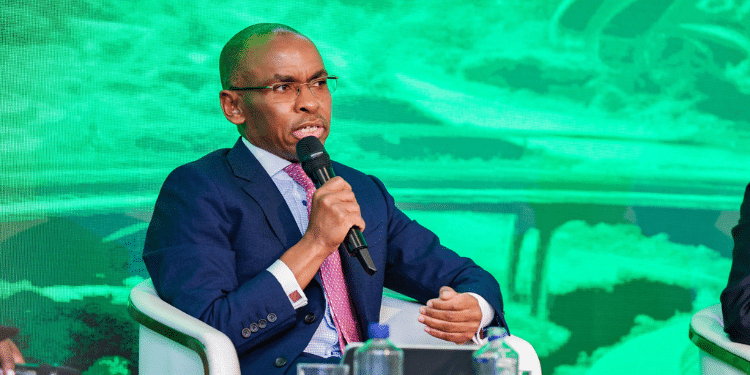

Speaking on the financial results, the Managing Director/CEO, Hamid Joda, said “since commencing operations two years ago, TAJBank has continued to record giant strides in the financial services industry.

“It is on record that we achieved break-even in our 8th month of business, recorded profit in our first year of operations while also wiping-off preoperational expenses in the first year of operation. Generally, the bank has continued to record excellent financial performance within the short period of its existence”, he added.

Also, the Executive Director, Sherif Idi, while reacting to the results said “TAJBank has a healthy appetite for growth and for excellence and these results are a testament to what we portray and what we are about.”

He also stressed that the bank “is not looking at slowing down in its sustained commitment to continue to add value to our shareholders, surpassing our customers’ expectations in innovative products and services delivery and in ensuring that we continue to break frontiers in the Nigerian financial system.”