Nigeria’s Central Bank Pumps $210 Million into Forex Market, Assures Of Naira Stability During 2019 Elections

CBN makes first foreign exchange intervention for the year 2019 with $210 million at the inter-bank market. Nigeria’s foreign reserves stand at $43.05 billion

Naira opens 2019 trading on a good positive notes, appreciating to N361/$1 at the parallel market.

Nigeria’s central bank (CBN) has injected the sum of $210 million into the inter-bank segment of the foreign exchange market, the first market intervention for the year 2019.

With less than 7 weeks to the 2019 polls, the CBN assured of stable exchange rates in spite of the anticipated pressures, coupled with election spending.

Isaac Okorafor, CBN Director, Corporate Communications, who made this known on Monday, January 7, 2019, said the wholesale sector of the market received $100 million, while the Small and Medium Enterprises (SMEs) received $55 million.

The CBN also allocated $55 million to customers requiring foreign exchange for business and personal travels, tuition or medical fees.

Okorafor reiterated that the apex bank will continue from where it stopped in 2018 in order to maintain FX stability.

He said the CBN had made a commendable effort in keeping the exchange rates at the current levels, noting that the current capital flow reversals from the emerging markets were expected to bring out pressures on the market rates.

“The CBN is determined to sustain a stable exchange rate as it continues to put in place relevant measures to shore up the country’s reserves,” he said.

NIGERIA’S FOREIGN RESERVES STAND AT $43.05 BILLION

Today, the foreign reserves dipped by $59.7 million to $43.05 billion from $43.12 billion it closed on the last day of 2018, according to a CBN data seen by Business Insider Sub-Saharan Africa.

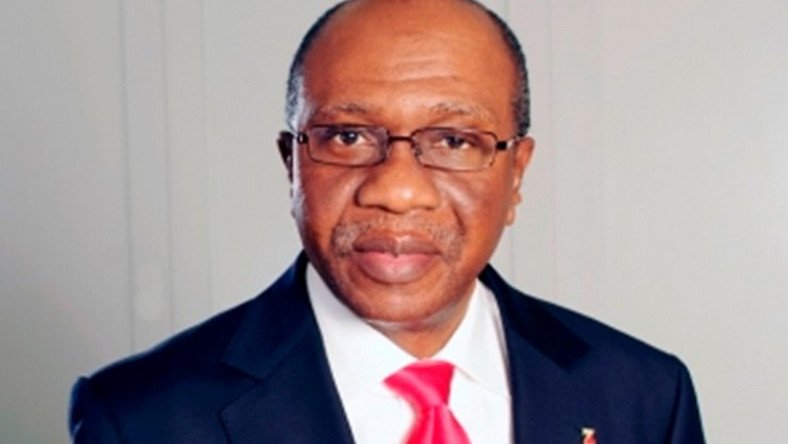

Godwin Emefiele, the CBN governor, had said the country’s target is to ensure stable currency rate to avoid depreciation of the naira.

Emefiele said the monetary authorities will rather trade off reserves build up in the place of foreign exchange.

NAIRA OPENS 2019 TRADING ON A GOOD NOTE

Nigerian naira, the local currency, closed at N361 to the dollar on recently, appreciating by N1 against the US dollar at the parallel market. This is about 0.55% appreciation from the average N363 it traded in 2018.

At the I&E – Investors’ & Exporters’ FX Window, the currency gained 0.01% at N365.35 per dollar while it closed flat at the CBN official market at N306.95 to a dollar.