OmniBSIC Bank acquires ISO certification for Exceptional Information Security Management System

As part of the bank’s commitment to protect its client’s sensitive information and ensure the highest standards of information security and privacy, OmniBSIC Bank is thrilled to announce their achievements of being awarded the International Organization for Standardization (ISO) certification for its Information Security Management Systems (ISMS).

The bank was recognized as compliant with the ISO/IEC 27001:2013 standard after rigorous external assessment of its information security policies, procedures, and practices, risk management processes, and the effectiveness of our security controls. To achieve this milestone, the bank showed a continuous and structured commitment to managing sensitive company and customer information.

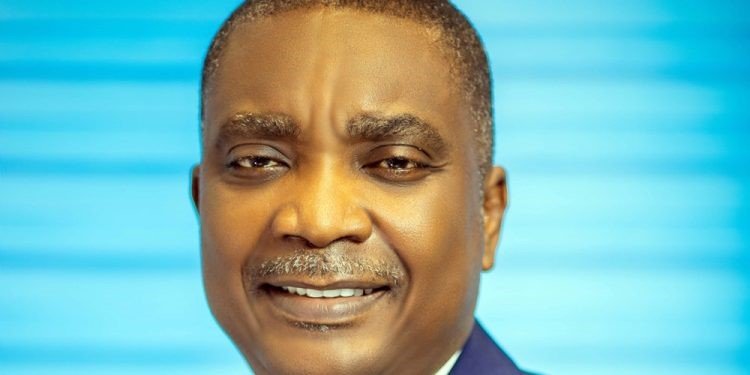

Remarking on the certification, Managing Director, Mr. Daniel Asiedu said: “The certification is another significant achievement for the bank as it confirms our commitment to providing excellent and innovative banking, characterized by superior standards of security, quality, and excellence. This is also an assurance to customers that their data is in safe hands and that the bank is taking the necessary measures to protect it. Our commitment to delivering exceptional levels of information security and privacy to our clients remains unwavering, and we assure all stakeholders of our continuous focus on excellence, information security, business resilience, and continuous improvement culture.”

He further expressed his gratitude to the Board, Management, and Staff for their dedication in reaching this milestone and for the crucial role played by the Bank’s shareholders.

The ISO/IEC 27001:2013 standard is an internationally adopted code of practice for Information Security Management Systems (ISMS). It provides a framework for managing processes and risks associated with information security objectives.

Achieving the ISO 27001 certification is an evidence that the Bank upholds its mandate to safeguard the confidentiality, integrity, and availability of its information assets related to its customers, processes, and technology.

In relation to the above, OmniBSIC Bank is poised for improved risk management and heightened customer satisfaction.

About OmniBSIC Bank

OmniBSIC Bank is a fully-fledged universal bank that traces its roots to a merger between the erstwhile OmniBank and Sahel Sahara Bank. The merger was spurned by the banking sector consolidation programmes introduced by the Bank of Ghana (BOG) in 2017, through several directives including the increment of the minimum capital requirement almost fourfold.

The union between the banks is one of the most successful mergers in the financial services industry. It can be described as synergistic since both banks shared similarities in business models, values, and customer experience and were both committed to offering exceptional customer service in Ghana’s banking industry. This milestone was achieved through the collaborative effort of shareholders, directors, management, and the staff who showed a willingness to embrace change to become bigger and better in the Banking industry.

OmniBSIC has reinforced its corporate governance structures and invested in its infrastructure to align with BOG’s Corporate Governance and other regulatory directives. The Bank is dedicated to maintaining the highest level of integrity, transparency, and accountability in all operations, thereby creating a reliable framework for clients to conduct their banking activities with us.

With their headquarters at Atlantic Tower, Airport City, and an extensive Branch network of 40 across Ghana, OmniBSIC provides a complete range of products, services, and digital offerings tailored to the needs of their Corporate, SME, and individual customers while supporting the communities in which they operate. In their commitment to creating excellent banking experiences for their customers every day, the Bank continues to invest in technology and employee development. All staff are thus carefully selected and developed through comprehensive training programs.

Source: citinewsroom.com