SSNIT misplaces US$11M after liquidating three companies – Report

The Social Security and National Insurance Trust, SSNIT, has misplaced over US$ 11 million due to the liquidation of three companies.

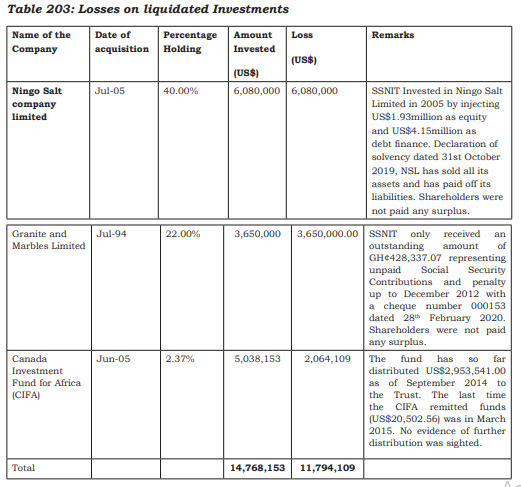

The Auditor-General’s report for the period – 31 December 2020 found that SSNIT liquidated three companies with a total investment of US$14.7 million.

According to the report, SSNIT did not receive any returns from two of the companies for investments made since 2005.

“We noted from our review of investment files that, the Trust liquidated three companies with a total investment of US$14,768,153.00. The Trust had not received any returns from the companies for its investment for the past 15 years. The loss from the liquidations amounted to US$11,794,109.” the report stated

From the audit report, management of SSNIT took over a lot of non-performing legacy investments, and efforts have been made to ensure that SSNIT gets the best deal when liquidations are evoked.

Liquidation of these companies led to a loss of US$11,794,109 of the Trust’s resources which could have been used to improve the pension’s funds, the report noted.

The Auditor-General has urged the management of SSNIT to “investigate the non-performance of the investments with the aim of ensuring value for money and ensure that effective feasibility studies are carried out before investing”.

Also, management has been asked to ensure that officers whose actions have led to the loss are appropriately sanctioned.

Companies in question

In the case of Ningo Salt Limited (NSL), the amount misplaced by SSNIT reduced from the stated US$6.08 million to US$1.93 million. The loan of US$4.15 million was granted through Ecobank Ghana Limited. Ecobank has fully repaid SSNIT with interest.

On Granite and Marbles Limited, SSNIT managed to retrieve its unpaid Social Security Contributions of GH¢428,337.07. All the loans were converted to equity prior to the liquidation.

Canada Investment Fund for Africa (CIFA) has been under liquidation since 2015. As per the Fund Manager’s 2019 report to shareholders, the liquidation process is yet to be concluded.

SSNIT recorded a deficit of GH¢427 million in the 2019 financial year, as compared to a deficit of GH¢442 million registered in 2018.

This represents a 6.8% increase in the Trust’s financial performance over the period.