Zenith Bank introduces Education Loan for Children

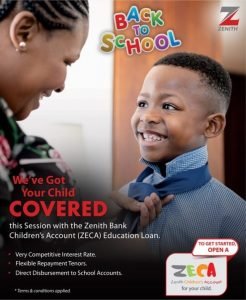

One of the fastest elevating financial and commercial service providers, Zenith Bank Plc has distinctively unveiled the Zenith Children’s Account (ZECA) Education Loan, to support parents/guardian, pay their children/wards school fees as the new school session commences soon.

The bank’s statement stated that, the loan offering, which is disbursed directly to the account of the beneficiary’s school, comes at a very competitive interest rate and flexible repayment tenors.

It further said that to access the loan, parents/guardians are required to open a ZECA account for their children/wards at any of the bank’s branches.

Speaking on the new loan product, the Group Managing Director/Chief Executive of Zenith Bank Plc, Mr. Ebenezer Onyeagwu said, “the bank remains focused on providing premium financial solutions that create value for its customers and meet their lifestyle needs.”

ZECA was explained in the statement as a specialised savings product for children between the ages of 0-17 years. The account enables parents/ guardians save towards securing the financial future of their children/wards.

“Zenith Bank Plc is recognised as one of the most innovative financial institutions in Nigeria and was voted the most customer-focused bank in Nigeria for the Retail and SME segments in the 2018 KPMG Annual Banking Industry Customer Satisfaction Survey (BICSS).” It said.

“The bank’s commitment to world-class service standards has led to several product innovations over the last few weeks including the Zenith Timeless Account, which allows Nigerians aged 55 years and above bank for free, the Zenith Save for Me, a high interest target savings account and Dubai Visa Service,’ on the Zenith Internet Banking Platform, which allows convenient application and payment for visas to Dubai,” the statement added.