Changes as Barclays rebrands to Absa

Barclays today advised its customers to be alert against fraudsters as it completed its legal name change to Absa Bank Kenya.

The bank formally rebranded into the warm red Absa colours recently, bidding farewell to the blue eagle emblem that has defined it for about 104 years.

The name change comes almost three years after Britain’s Barclays sold most of its controlling stake in Absa, South Africa’s third-largest lender, ending more than a century of the British bank’s involvement in Africa to focus on its home market and the United States.

According to the bank, it said that fraudsters could take advantage of the transition to try to dupe Absa Kenya customers into giving away crucial bank accounts information as it formally transitions from Barclays brand.

It added further that: “Customers are urged to be particularly vigilant during this time, as fraudsters are always looking for opportunities to obtain important personal information. The bank will not be asking customers for any information regarding their accounts”.

Fraudsters have in the past used corporate shifts such as name changes, branch expansions and roll out of new technology to steal from customers by obtaining information such as account numbers and passwords.

Absa further declared recently that it had received all requisite shareholder and regulatory approvals, enabling it to shift to the new name.

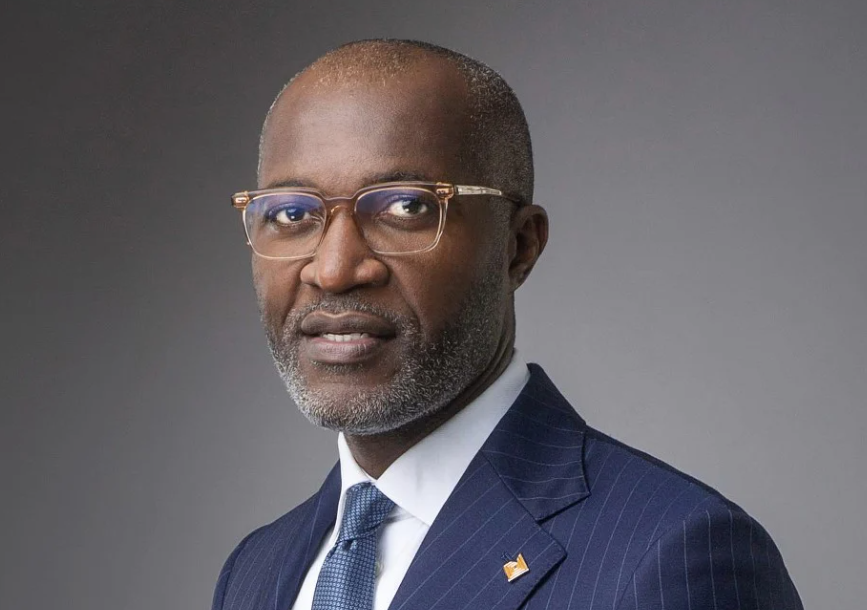

Speaking on the rebranding, the Managing Director, Jeremy Awori, said: “This is a major milestone for our business, and we will be engaging stakeholders in the coming days to celebrate the successful launch of the Absa brand”.

The Nairobi Securities Exchange (NSE) also halted the trading of Barclays Bank of Kenya shares recentrly to facilitate the settlement of all outstanding obligations as the bank changed its trading name.

In addition,its ticker code at the bourse also changed from BBK to ABSA.

Barclays bought a majority stake in Absa in 2005, but reduced its stake in 2017 from 62 percent to 15 percent by selling shares to large investors, including South Africa’s Public Investment Corporation.

Absa Kenya disclosed last year it has spent Sh910 million in rebranding expenses in the nine months to September 2019.

Notably, Barclays Life Assurance Kenya Limited has also changed to Absa Life Assurance Kenya Limited effective today.