Access Bank improves in performance for 2021 first half

Access Bank has documented a strong growth in its financial performance for the first half of the year, with a 16% and 12% growth in its net interest income and profit before tax respectively.

This was revealed at its annual “Facts behind the Figures” virtual session, held recently.

“Facts behind the Figures”, an event organized by the Ghana Stock Exchange for its listed companies, offers a platform for the companies to present their performance to key stakeholders, Investors and the public through the media.

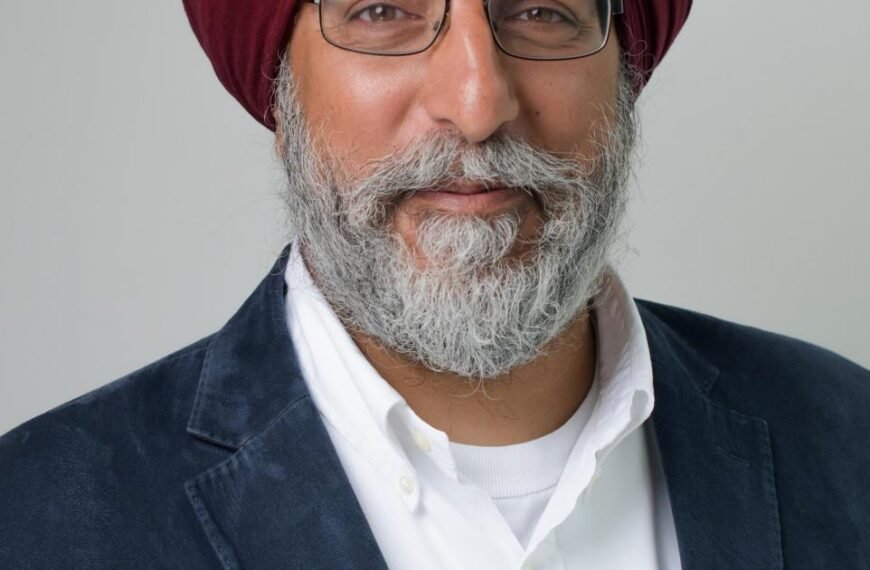

Presenting on the first-half performance of the Bank, Managing Director of Access Bank, Mr. Olumide Olatunji was thrilled at the growth trajectory of the bank and commended the impactful efforts made by staff in achieving this feat.

He said “The Bank’s net interest income grew from 188 million to GHS218 million, while profit before tax grew from GHS193 million to GHS216 million year-on-year. Based on that, the Bank is well-positioned to maximize and return value to shareholders, while contributing its quota to Ghana’s development.”

On the organization’s outlook for the medium term, Mr. Olatunji made it known that the Bank will continue to grow its retail banking, consolidate wholesale banking and further deepen its position on digitalization.

“The Bank will continue to explore digitally-led solutions to customers across multiple segments as it strives to deepen digitalization towards a cash lite society. These solutions are being rolled out on the back of robust state-of-the-art security-enhancing architecture,” He stated

“Incorporating advanced analytics to tailor products to customers’ needs and manage risks across multiple businesses and markets are key strategic focus of the Bank in the medium term and significant investments are being made to ensure this,’ he added.

The COO of the Bank Mr. Ade Ologun used the opportunity to assure customers and investors of the security measures put in place by the bank to ensure the safety of customers’ assets and investments.

The CFO of the Bank, Mr. Michael Gyabaah also stated that, Access Bank has demonstrated a strong and disciplined growth over time which have well-positioned it to return value to shareholders.

The highlights of this performance have contributed to the Bank being recognized in various awards including the 2020 “Global Financial Inclusion Award” by the Banker Magazine, “Most Innovative Retail Banking Brand”, and best ‘CSR Bank” in Ghana for the year 2020 by Global Brands as well as Best Company in Customer Service by Ghana Customer Service Index (GCSI).

Source: Ghana Stock Exchange