Access Holdings to pay $109.6m for Kenya’s NBK acquisition

Access Holdings Plc, Africa’s largest banking conglomerate by assets, has disclosed plans to remit $109.6 million (₦179.1 billion) to finalize its acquisition of National Bank of Kenya (NBK) from KCB Group Plc, as revealed in the company’s Q2 2025 financial statements.

The transaction, first announced in March 2024 and formally completed on May 30, 2025, following regulatory approvals from the Central Bank of Kenya (CBK) and Nigeria’s Central Bank (CBN), marks Access’s second major foothold in Kenya, following its rebranding of Transnational Bank in 2020.

Once fully integrated, the merged entity will elevate Access Bank Kenya to a Tier II lender status, bolstering the group’s presence in East Africa’s vibrant financial market and unlocking opportunities for government-linked clients and expanded branch networks across 28 Kenyan counties.

The deal encountered hurdles earlier this year when the CBN flagged concerns over Access Bank’s exposure in high-risk markets, including regulatory non-compliance at its Democratic Republic of Congo subsidiary, prompting payment delays. To bridge this, Access, KCB, and the African Export-Import Bank (Afreximbank) inked a $89.5 million (₦142.3 billion) guarantee agreement on May 30, securing the seller’s interests until all approvals clear.

ALSO READ: ABSA GROUP ACQUIRES STANDARD CHARTERED UGANDA RETAIL, WEALTH PORTFOLIO

As of June 30, 2025, final unconditional regulatory green lights remain pending, meaning NBK’s financials are not yet consolidated into Access’s reports—despite operational integration underway, including shared branch access for customers since September. Access Bank Kenya, meanwhile, posted a $1.47 million loss in H1 2025 amid operational costs, contrasting sharply with the Nigerian parent’s ₦165.16 billion ($113.28 million) profit.

In a parallel expansion stroke, Access Holdings announced a binding agreement with South Africa’s Bidvest Group Limited to snap up 100% of Bidvest Bank Holdings for ZAR 2.3 billion (about $122 million), a deal inked in December 2024 and slated for closure in the second half of 2025 pending regulatory scrutiny.

Bidvest Bank, a niche player founded in 2000 with $665 million in assets and $20 million in pre-tax profit as of June 2024, specializes in corporate, SME, and retail banking, including foreign exchange and fleet services. The acquisition aligns with Access’s pan-African strategy to fortify South African operations, blending Bidvest’s local prowess with Access’s trade finance expertise to drive intra-African commerce and introduce black economic empowerment initiatives like employee stock plans.

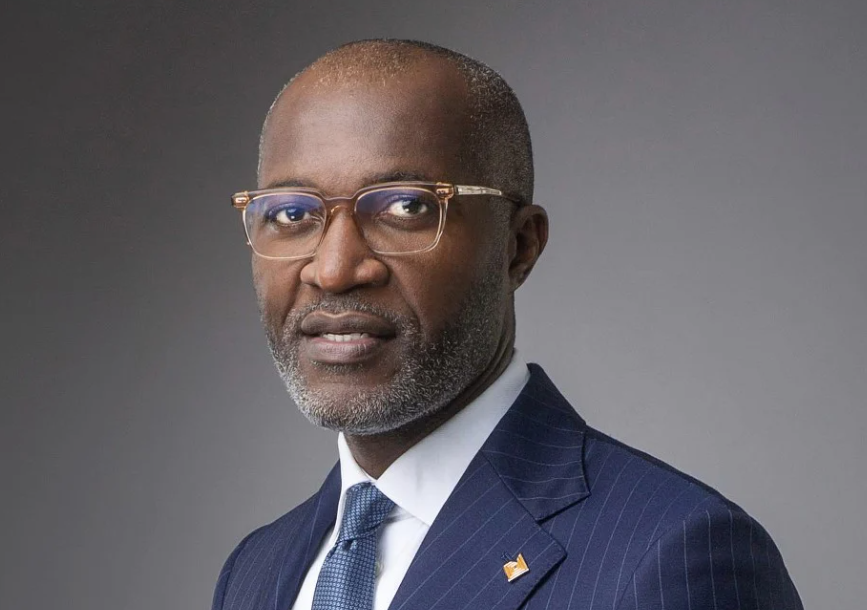

Roosevelt Ogbonna, CEO of Access Bank Plc, hailed the moves as pivotal for continental integration: “These acquisitions underscore our resolve to become Africa’s gateway to global markets, leveraging technology and strategic partnerships to deliver resilient, customer-centric banking amid economic volatility.”

With over 700 branches serving 60 million clients across 20+ countries, Access Holdings’ aggressive footprint growth—projected to enhance its market share in key hubs like Kenya and South Africa—signals a bold bet on diversified revenue streams, even as it navigates currency fluctuations and regulatory landscapes.