Afreximbank urges export trading companies to drive African small and medium enterprises

The African Export-Import Bank has called on African countries to prioritize the development of public and private export trading companies (ETCs) in order to position the continent’s small and medium enterprises (SMEs) to participate effectively in global trade.

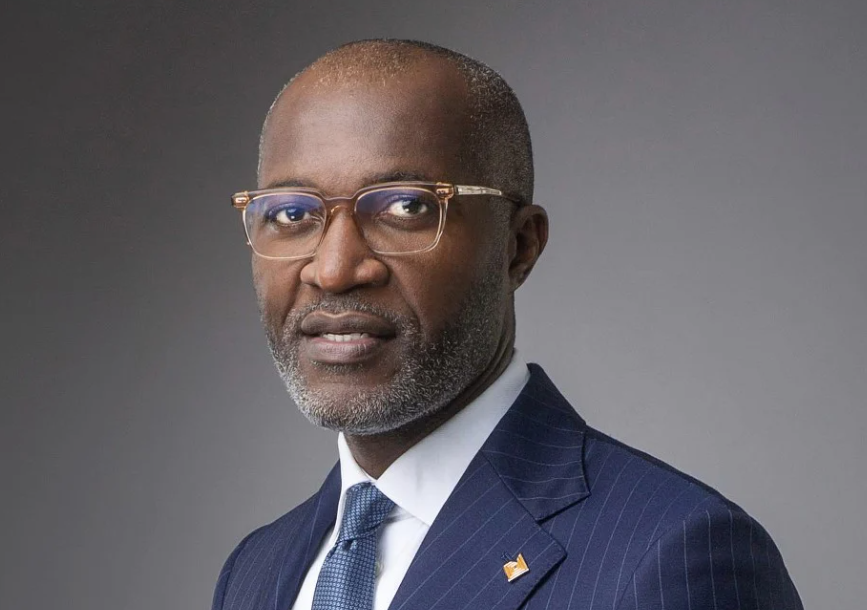

In an address to the Africa International Exhibition, which opened on the sidelines of the United Nations General Assembly in New York, Kanayo Awani, Afreximbank’s Executive Vice President, Intra-African Trade Bank, speaking on behalf of Bank President Prof. Benedict Oramah, said that SMEs participating directly in global trade faced stiff competition from multinational and significantly large corporates, making their chances of success or survival marginal, if not zero.

Kanayo Awani noted that Asia had addressed that challenge by establishing ETCs to act as conduits through which SMEs accessed global markets, explaining that ETCs acted as aggregators and created a sizeable volume of trade that attracted greater value and with stood competition.

She said that the limited participation of Africa’s SMEs in global value chains reflected institutional policy failure and called for strong policy support systems that would provide capacity developments, incipient protections from unfair competition and improved access to regional markets and access to finance.

“These are particularly urgent as Africa commences implementation of the African Continental Free Trade Agreement (AfCFTA)” she said.

She announced that, over the years, SMEs had been a central focus of Afreximbank’s continental interventions through its export development SME-focused strategy, with unique funding instruments to bridge the financing constraints faced by African SMEs, including products, such as factoring, supply chain finance and intermediated financing.

Kanayo Awani said that Afreximbank was the principal promoter of factoring in Africa and that the factoring law it sponsored had been adopted in the Republic of Congo, Burkina Faso, Niger, Togo, Mali and Cote d’Ivoire and was under consideration by regulatory institutions in several other African countries.

The Bank was also enabling market access for African SMEs through the African Trade Gateway, a digital ecosystem which comprises assets designed to address non-tariff barriers, such as the MANSA customer due diligence repository platform which collects KYC information of SMEs and corporates and which had already onboarded more than 11,000 entities, she said.

Source: ApoGroup