BANK OF GHANA AND BANKS REACH AGREEMENT ON DOMESTIC DEBT EXCHANGE PROGRAM

The government and the Ghana Association of Banks have reached a conclusion over the Domestic Debt Exchange Program.

The Association had earlier instructed commercial banks to hold off on approving the revised debt exchange offer until its members’ needs were satisfied.

They added, this was to clear the lack of confidence surrounding how the debt restructuring would affect the banking sector.

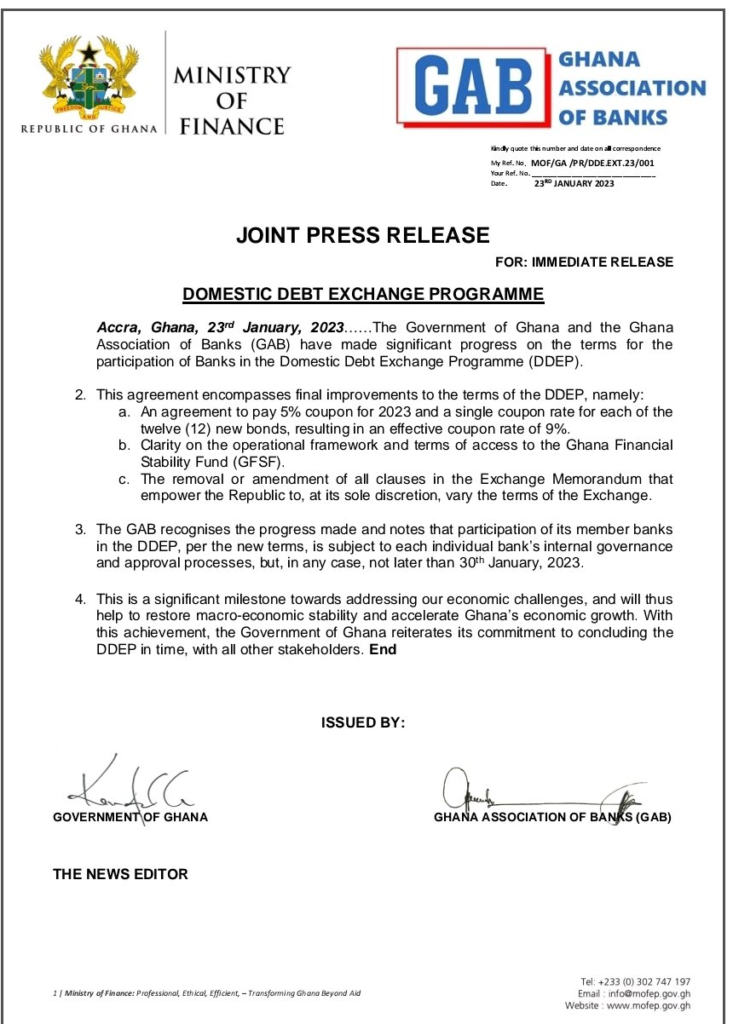

In a joint statement, both parties have agreed to pay 5% coupon for 2023 and a single coupon rate for each of the twelve (12) new bonds, resulting in an elective coupon rate of 9%.

However, the statement further added that “The GAB recognises the progress made and notes that participation of its member banks in the DDEP, per the new terms, is subject to each individual bank’s internal governance and approval processes, but, in any case, not later than 30th January 2023.”

Attached is a copy of the release.