Bank of Ghana positive on inflation outlook despite fiscal risk

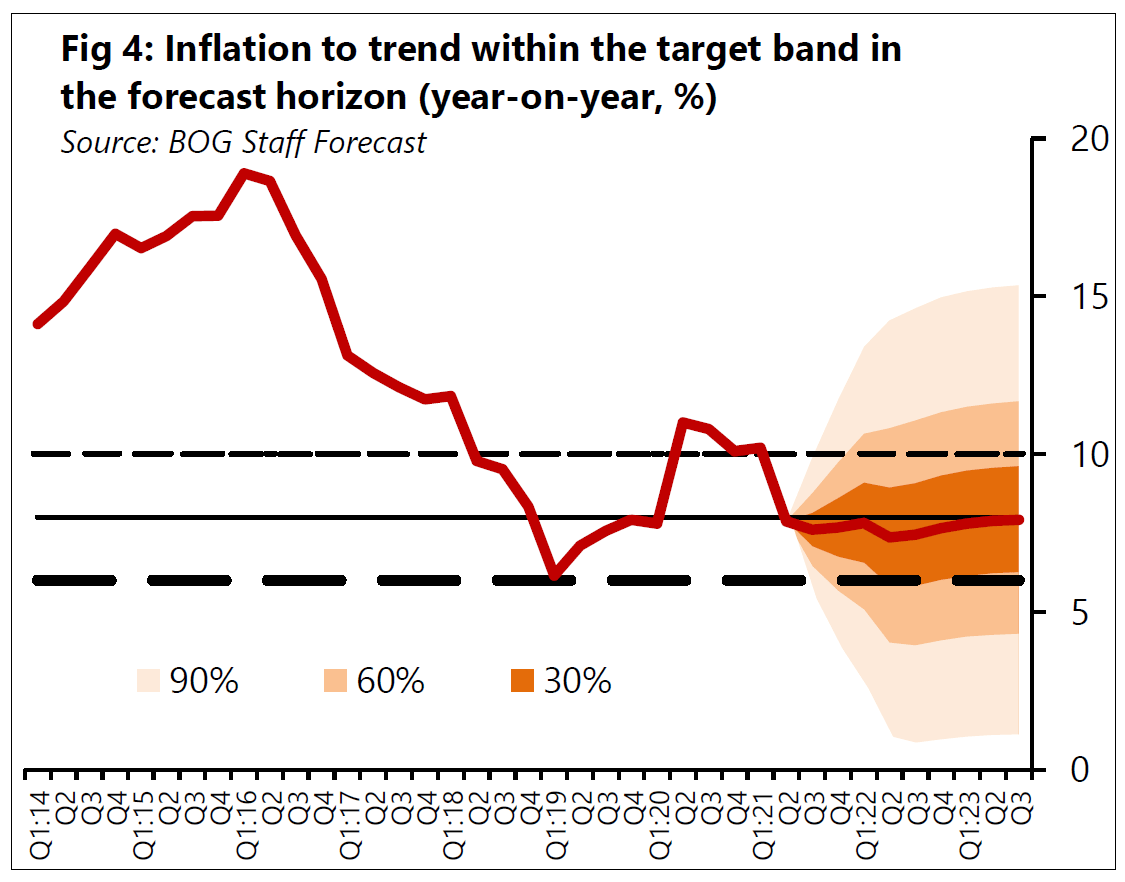

The Bank of Ghana has forecasted the headline inflation to remain within the medium-term target band of 8±2 percent despite it inching up in the past two months.

Even though the inflation will remain within the medium-term target band of 8±2 percent, Bank of Ghana has expressed concern about risk from the fiscal side.

Domestic price pressures moderated during the second quarter of 2021, causing headline inflation to reduce significantly from 10.3 percent in March 2021 to 7.5 percent in May 2021 before ticking up to 7.8 percent and 9 percent in June and July 2021 respectively. The Bank is however confident that inflation will remain in the medium-term target band.

According to the Bank, the latest outlook reflects favourable base-drift effects due to the waning impact of the COVID-19-induced spike in food prices, which occurred in the second quarter of 2020, and the tight monetary policy stance. However, it remains wary of any unforeseen shocks, especially fiscal slippages.

The bank, in its report said “The July baseline projection forecasts inflation to remain within the medium-term target band of 8±2 percent in the outlook barring any unforeseen shocks, especially fiscal slippages,”.

Assessments of risks to the inflation outlook from global economic conditions, domestic economic activity, and government’s fiscal policy implementation amid the pandemic suggest that the balance of risks to the inflation outlook is largely subdued.

“The key upside risks to the outlook include the projected uptick in food prices, rising ex-pump prices of petroleum products, and possible fiscal pressures in the outlook,” the Bank stated.

In the forecast, food and non-food inflation are projected to hover around the central path driven broadly by low production costs, while imported inflation is expected to exert some upward pressure as prices continue to remain elevated in the US.

Costs in both the food and non-food sectors are projected to be low, reflecting the prevailing spare capacity – the negative output gap – as well as projected stability of the exchange rate in the outlook. However, production costs are projected to rise in the medium-term as economic activity fully recovers.

Food inflation dipped markedly from 10.8 percent in March to 6.5 percent in April; to 5.4 percent in May 2021 and then up to 7.3 percent and 9.5 percent in June and July 2021, respectively. Non-food inflation, on the hand, has declined persistently; falling from 10 percent in March to 8.2 percent in June 2021, but rising in July 2021 to 8.6 percent.

The Bank is projecting the real sector activity to remain below potential in the near-term, on the back of tighter monetary conditions, real sector expectations, and fiscal consolidation.

Nonetheless, economic activity is expected to approach full capacity in the medium-term, driven by higher impulses from global demand and improvement in the expectations of economic agents as the economy better-adapts to the COVID-19 pandemic.