CBN Issues Guidelines For $2.5bn Currency Swap with China

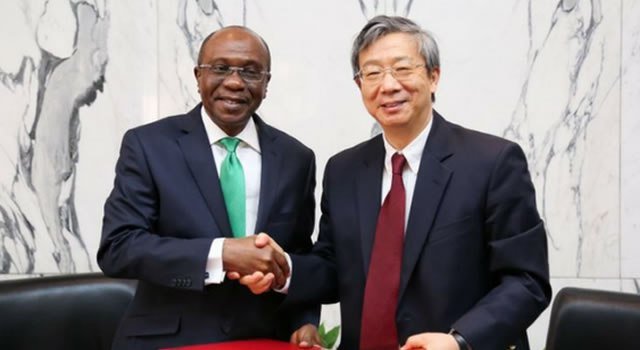

The Central Bank of Nigeria (CBN) said it will exchange N720 billion for 15 billion Chinese Renminbi (RMB) in three years under the $2.5 billion bilateral currency swap (BCS) with Peoples Bank of China (PBoC). Emefiele CBN Governor The apex bank disclosed this in the guidelines for executing the BCS released yesterday, adding that it would conduct bi-weekly auction for banks to bid for the Chinese currency on behalf of their customers.

Titled, ‘Regulations for Transaction with Authorised Dealers in Renminbi’, the guidelines stated that the BCS can only be used to finance trade and direct investment between China and Nigeria; maintain market stability; and for other purposes that both parties may agree upon.

It stated that: “The CBN may conduct bi-weekly Renminbi bidding sessions; The Renminbi sales shall be applicable only to trade-backed transactions; Importers and Exporters shall continue to pay the applicable levies on imports and exports respectively; Authorized dealers are required to utilize funds within 72 hours from the value date, failing which such funds must be returned to CBN for repurchase at the Bank’s buying rate; CBN shall debut authorized dealers’ current account on the day of intervention with the Naira equivalent of the Renminbi bid quest; Bids shall be settled spot through a multiple-price book bidding process and will cut-off at a marginal rate.”

On criteria for participation in the bi-weekly bid, CBN stated: “All authorised dealers shall open Renminbi accounts with a correspondent bank and advise CBN with its Renminbi Account details which may either be with a bank onshore or offshore China; Importers intending to import from China shall obtain Proforma invoice denominated in Renminbi as part of document required for the registration of Form M; Forex purchase in the window shall not be used for payments on transactions in which the beneficiaries are not in China; Authorized dealers shall not open a domiciliary account denominated in Renminbi for customers; For purpose of this regulation authourized dealers shall be deposit money banks and merchant banks.”

Culled from Vanguard