Nigeria: Market Sentiment Turns Positive, NGX ASI Inches Up By 9bps To Close At 42,357.36 Points

At the end of yesterday’s trading session, the Nigerian equities market closed positive as the benchmark index improved by 0.09% to close at 42,357.36 points. This was mainly due to buy pressures in bellwether stocks such as MTNN (+0.11%) and GTCO (+2.40%). Consequently, the YTD return increased to 5.18% as market capitalization improved by ₦20.79 billion to close at ₦22.10 trillion.

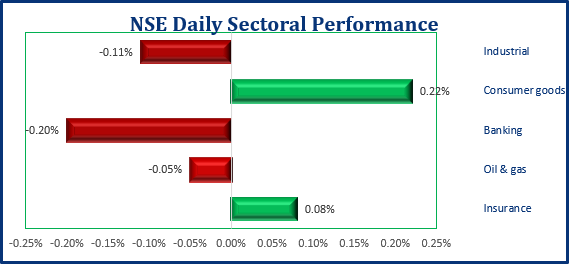

The sectoral performance marginally weakened as three of the five indices under coverage declined. The Banking index, the biggest loser, declined by 0.20% on UBA (-1.90%). The Industrial and Oil & Gas indices followed suit, falling by 0.11% and 0.05% on WAPCO (-1.61%) and ARDOVA (-0.74%) respectively. On the flip side, the Consumer Goods and Insurance indices, the gainers improved by 0.22% and 0.08% on NB (+1.05%) and CHIPLC (+1.72%) respectively.

Investor sentiment strengthened as market breadth increased to 1.46 from 0.72x. This was illustrated by the advance of 19 stocks, led by REDSTAREX (+7.94%) and MEYER (+7.69%) and the decline of 13 stocks, led by ETRANZACT (-9.57%) and ROYALEX (-4.76%). Activity level was mixed as the total volume declined by 16.26% while the total value improved by 14.50% as investors exchanged about a 226.18million units of shares worth over ₦2.63billion.

Fixed Income

There was bearish sentiment across the bond yield curve as 3 of the 4 bond yields under coverage closed higher while the yield on the FGN-JAN-2026 bond paper closed flat at 11.28%. The yields on the FGN-APR-2023, FGN-APR-2024 and FGN-JUL-2030 bond papers increased by 25bps, 12bps and 3bps respectively.

Treasury bill yields for the 91, 182 and 364-day papers closed flat at 3.00%, 3.74% and 5.63% respectively.

MARKET SNAPSHOT

- Positive Performance Returns in the Local Bourse, NGX ASI Gains 9bps

- Bearish Sentiment across the Bond Yield Curve

- Positive Sentiment in Global Stocks

- Negative Performance in the Commodities Market

- Positive Performance in African Stocks