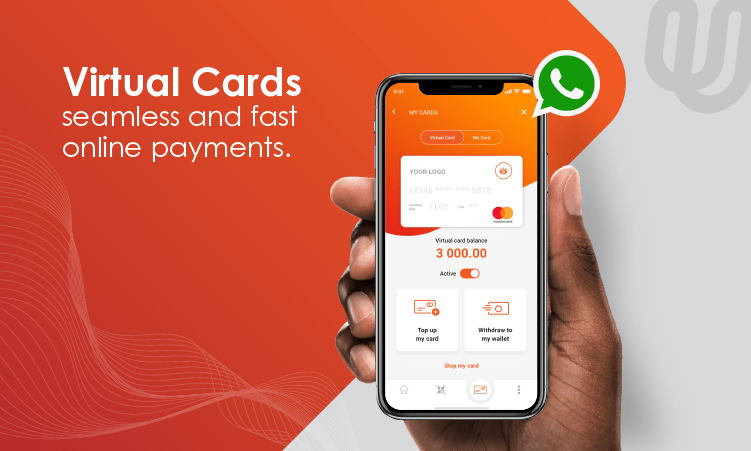

First WhatsApp virtual Card on the cards from Telkom

A quartet of companies in the Fintech space, Ukheshe Technologies, Mastercard, Nedbank and Telkom have bandied together for a launch of Africa’s first virtual card for use on WhatsApp, thus enabling Telkom Pay customers to make e-commerce payments easily. This move is expected to empower millions of South Africans – even those without a bank account – to access the digital economy and transact online.

Telkom Pay is a digital payments wallet launched in 2020 that enables its users to make and receive payments using WhatsApp on their mobile phone.

With the addition of the Mastercard virtual (non-plastic) card to the wallet, users can now make payments to local and global online merchants that accept Mastercard, including Uber and Netflix.

Commenting on the new move, Telkom Managing Executive for Financial Services, Sibusiso Ngwenya, said they were proud to lead the way in launching the first virtual card through WhatsApp on the continent. “This ensures greater financial inclusion through affordable products and services that cater to everyone and are easily accessible through a mobile device at any time.”

Telkom’s move to bring virtual cards into its Telkom Pay WhatsApp service is a result of close collaboration with Mastercard, Nedbank, and leading fintech enablement partner, Ukheshe Technologies.

According to Suzanne Morel, Country Manager for Mastercard, South Africa, it’s an important step forward in improving access to the digital economy seeing that people now are increasingly shopping online. This digital-first solution bridges the divide by giving consumers instant access to a virtual payment solution through WhatsApp, without compromising the safety and security of transactions. Together with our partners, we are helping more people to benefit from the choice and flexibility that a growing, inclusive digital economy brings.”

Telkom’s Mastercard virtual card for WhatsApp gives customers the flexibility to shop safely and conveniently using just their smartphone and the Telkom Pay app. Customers simply create a virtual card on their profile, link it to their digital wallet and transfer funds from their wallet to the card.

To pay for purchases, users receive a virtual prepaid card – including a 16-digit card number, security code and expiry date, which they use to complete an online purchase much like they would with a physical card.

The virtual card solution is safely stored on the Telkom Pay app and customers can temporarily block, cancel or replace their card via the app, providing them with additional security and control.

“We are thrilled to assist Telkom in making new, innovative products possible, and look forward to continuing our journey of supporting clients in their efforts to offer cutting-edge payment solutions to people who need them most,” said Clayton Hayward, CEO of Ukheshe.