UBA Shareholders Laud N29.1bn Dividend Declared For 2018

United Bank of Nigeria (UBA) Plc shareholders recently approved payment of N29.1 billion dividend for the financial year ended December 31, 2018. The dividend translated to 20k interim dividend paid in September and final dividend of 65k per share, bringing the bank’s total dividend declared to 85k per share.

The News Agency of Nigeria (NAN) reports that the shareholders gave the approval at the bank’s 57th Annual General Meeting (AGM) held in Lagos. Speaking at the meeting, Dr Farouk Umar, Chairman, Association for the Advancement of the Rights of Nigerian Shareholders, lauded the bank for improved dividend declared during the period under review.

Umar said that the bank had maintained enhanced dividend payout in spite of the challenge being experienced in the operating environment. He, however, said that shareholders were expecting nothing less than N1 dividend from the bank in the current financial year.

Also speaking, The National Coordinator, Progressive Shareholders Association of Nigeria, Boniface Okezie, who appreciated the bank for growth recorded in all performance indicators, bemoaned regulatory charges being imposed by regulators on commercial banks. Okezie said that regulators should look for other ways of making money instead of shortchanging shareholders.

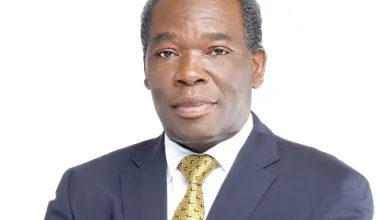

He further commended the bank’s Chairman, Mr Tony Elumelu, for supporting youth development and job creation through his foundation. Responding, Elumelu said that the bank would continue to deliver superior return to all esteemed shareholders, going forward. He said that the company was on a stronger footing to gain market share in Nigeria and the other 19 African countries where it operates.

The Group’s Managing Director, Mr Kennedy Uzoka assured shareholders of better returns in the years ahead. “We have a duty to look beyond today, we look into the future in UBA. “As we progress with the execution of our strategies, we approach 2019 with stronger optimism. “Our immediate priorities are clear; our collective commitment to a service delivery that always surpasses the expectations of customers,” Uzoka added.

NAN reports that the group posted profit before tax of N106.77 billion compared with N104. 22 billion achieved in the corresponding period of 2017. Profit after tax stood at N78.61 billion in contrast with N77. 55 billion in 2017.