Fidson records N16.23 billion turnover

The leading pharmaceutical manufacturing company in Nigeria, Fidson Healthcare Plc in its 2018 audited financial report to the Nigerian Stock Exchange (NSE) posted 15 per cent growth in turnover from N14.06 billion in 2017, to N16.23 billion in 2018.

The increase in revenue was as a result of volume growth from expanded production at its new World Health Organisation’s compliant factory.

The plant, which was commissioned in 2016, is a key driver of the company’s growth strategy and local sourcing initiatives.

The new factory is one of the most sophisticated manufacturing facilities in Africa and is well positioned to meet the rising demand for medicines in Nigeria and the broader West-African region.

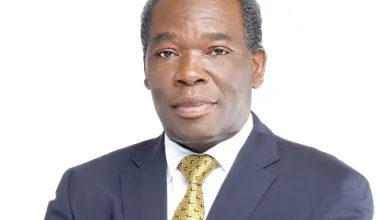

The Managing Director of the company, Fidelis Ayebae, said the growth in revenue was achieved in spite of a challenging year for the pharmaceutical industry, which saw some therapeutic substances banned by the government and costs increasing on key production inputs.

According to him, as a result of these challenges, the company’s cost of sales went up by over 40 per cent from N6.90 billion in 2017 to N9.91 billion in 2018.

“Other factors that affected its cost of sales include increased logistics cost for imported materials due to congestion at the seaports which drove up the cost of transporting goods from the ports by 1000 per cent.

“These factors, together with price depressions that affected some generic products, led to a drop in gross margin by 11 percentage points. Despite the sharp increase in cost of sales, operational efficiencies and various cost optimisation strategies implemented by management reduced the impact on operating profit, which declined by about 20 per cent, less than half the level of increase in production costs.

“However, the operating profit of N2.05 billion was eroded by the sharp increase in net finance costs of N1.89 billion arising from increased borrowings and high cost of funds,” he said.

Furthermore, Ayebae noted that the company has begun the process of correcting this trend through its fund-raising initiatives, including a rights issue, noting that the issue transaction is currently open and closes on April 9th.

“About 60 per cent of the rights issue proceeds will be applied towards taking out expensive short-term debts, thereby reducing finance cost by about 50 per cent on an annualised basis going forward,” he said.

He said the company also intends to take advantage of the fund raise to inject fresh working capital into the business in order to maximise the opportunities that exist in the market.

He added that a revenue growth of over 20 per cent is projected for 2019, with increased focus on growing its ethical product segments.

“The business development work being done in hospitals to enhance the patronage of Fidson brands is also expected to increase demand. About 20 new products will be introduced into the market in 2019 to take advantage of the available capacity at the new factory.

“Further cost savings will be generated by directly importing key raw materials, taking advantage of the CBN window for manufacturers, and renegotiating with its suppliers.

Ayebae added that, “The Company is also switching its energy source from diesel to gas. Fidson expects, through its cost savings initiatives, to reduce production costs and increase gross margins significantly in 2019. The prospects look good for Fidson in the near-term, enabling the Company to cement its leadership position in the pharmaceutical industry”.